Last year the spread between electricity contracts and energy withdrawn was negative 10%, doubling the 2014 surplus.

Slowdown hits electricity demand: distributors had record surpluses in 2015

It is not only the electricity demand of large customers that has fallen in the last year, as a consequence of the economic slowdown. This has also been the case for small and medium-sized consumers operating in the regulated market.

According to the register of contracts of electricity distributors, prepared by the Center for Economic Load Dispatch of the Central Interconnected System (CDECSIC), during the past year the gap between amounts awarded and invoiced for supply contracts with generators doubled.

In other words, the distributors sold much less than what was projected in the supply contracts themselves. This resulted in lower dispatch by generators for these types of customers and greater exposure to the spot market for companies operating in the center-south of the country.

At the macro level, distributors projected a demand of 33,929 GWh, 3,224 GWh more than what was actually withdrawn.

In the previous year, the gap between projected and withdrawn demand was almost 50% smaller, as distributors estimated a demand of 30,714 GWh and withdrew 29,150 GWh, or 1,564 GWh.

Overall, the market trades with some slack, but not as much as it did in 2015.

At the same time, this situation had a direct impact on generator sales. In the case of Colbún, for 2015 it had been awarded some 6,912 GWh, but finally generated 6,180 GWh . This was reflected in the company’s financial results at the end of 2015.

“Physical withdrawals of customers under contract during the fourth quarter of 2015 reached 2,707 GWh, 7% lower compared to the same period of the previous year, mainly due to the expiration of the contract with Conafe in April 2015 and lower demand from regulated and free customers,” warned the generator linked to the Matte family in its most recent reasoned analysis.

Something similar happened with Endesa and AES Gener. In the case of the former, its commitments for this year totaled 18,149 GWh, but it supplied 16,724 GWh, a reduction of 8%. AES Gener, meanwhile, supplied 4,832 GWh of the 5,605 GWh contracted (-14%).

Experts warn that this phenomenon is not new, as it is usual for distributors to request more energy than demand projections. However, this margin has widened more than expected as a result of the slower pace of the domestic economy.

“There is always a difference, in general the differences are related to the fact that the distributors overestimate their consumption. Now there is much more because demand has a direct relationship with the growth of the gross domestic product (GDP) and when distributors make their estimates they do it well in advance, we must remember that they make long-term contracts, and particularly the GDP growth has been modified several times in recent months,” says Maria Isabel Gonzalez, general manager of the consulting firm Energética.

This was shared by Hugh Rudnick, director of the consulting firm Systep, who explained that “to the extent that the economy slows down, our energy matrix follows it very closely, the GDP grows 1% and energy grows 1-1.2%, electricity consumption is very closely coupled to the economic situation. So, to the extent that the country has been slowing down, electricity growth has also been slowing down and freezing”.

Regulated customers are those with electricity consumption up to 10,000 kW -those between 500 and 10,000 kW can choose-. This segment includes households and small and medium-sized industrial companies. As explained, the higher demand than projected does not come from households, whose demand is practically inelastic, but rather from industry.

What does the regulation say?

The regulation on electricity supply bids for regulated customers states that the monthly energy to be billed by all of the concessionaire’s supply companies may not exceed the total energy actually consumed by customers subject to price regulation in the respective month, in accordance with Article 134 of the General Law of Electric Services.

It also establishes that “if in a given month the energy actually consumed by the customers subject to price regulation of the concessionaire is lower than the energy of all their current contracts, the billing will be adjusted in a non-discriminatory manner”.

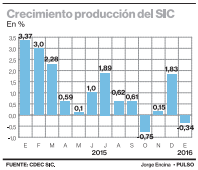

After the first month of the year showed negative growth figures (see graph) in the central system and with projections that electricity demand will be slightly above 1%, the big question that arises is the fate of the projects. To date, there are 38 power generation projects under construction in the SIC, with a total capacity of 2,967 MW, and another 31 initiatives for 2,581 MW in the SING. All these projects will be completed by 2018.