This morning, Spain’s Naturgy announced the transfer of the Chilean distributor to the Asian firm for US$3 billion.

By S. Sáez, C. Rivas and I. Badal

Source: La Segunda, Friday, November 13, 2020

China State Grid International Development Limited (SGID) will become, if the Chilean authorities allow it, the strongest player in electricity distribution in our country.

The Chinese company, which had closed the acquisition of Chilquinta Energía and Luz Linares for US$2.23 billion in mid-October last year, now announced the purchase of 96% of Compañía General de Electricidad (CGE) for 2.57 billion euros (some US$3 billion) from Spain’s Naturgy (whose financial advisor was Banchile Citi).

The announcement rocked the Madrid stock market, where Naturgy shares soared more than 6%. In the Chilean market, CGE’s shares that are still traded (equivalent to about 4% of its ownership) jumped more than 162% to $1,099 at the opening, but were suspended 40 minutes later.

According to Naturgy’s essential fact in Spain, the transaction involves valuing 100% of CGE in terms of “Enterprise value” (total value of a company’s assets) of 4,312 million euros (US$5 billion).

“It should be looked at with care.”

CGE currently has 3.1 million customers and a 44% share of the national market, which alone makes it the largest distributor in the country, ahead of Enel Distribución (ex-Chilectra), which only operates in Greater Santiago and has 1.9 million customers, with a 27% share. If Chilquinta and Luz Linares, which have 890 thousand connections, or 11.5% of the market, are added, the Chinese State Grid would have almost 4 million customers and 56% of all electricity distribution in the country, and practically this market would be in the hands of two large players: State Grid and Enel. Much lower is the Saesa Group, which serves 528 thousand customers (at the end of 2019) and local distributors.

The Minister of Energy, Juan Carlos Jobet, warned that this operation will have to be reviewed by the National Economic Prosecutor’s Office (FNE).

“The companies must submit to the merger control procedure before the FNE, which can approve the operation, approve it with conditions or reject it, based on the substantive analysis of its effects on competition,” explained Fernando Araya, antitrust lawyer of the Lewin law firm.

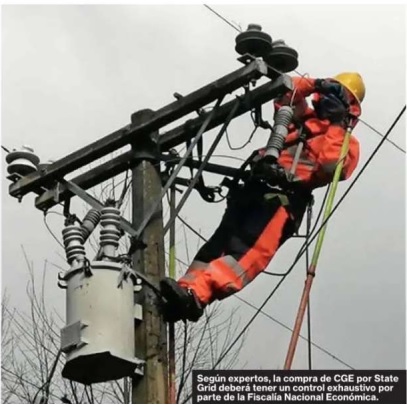

“The FNE will have to observe this operation very carefully, as it undoubtedly exceeds the thresholds for requiring a preventive control of concentration, especially taking into account that it involves electricity distribution, a market that is a regulated natural monopoly,” said lawyer Tomás Menchaca, former president of the Tribunal de Libre Competencia (Court of Free Competition).

Challenges and synergies

CGE’s new controller faces several challenges. “The most important is how to make CGE’s operations talk to Chilquinta to take advantage of synergies, reduce costs and improve services,” believes Rodrigo Jiménez, general manager of the consulting firm Systep.

In quality of service, CGE is quite low in the annual ranking of the Superintendency of Electricity (SEC). In 2019 it ranked 21st out of 25 companies, although the top places included cooperatives or small companies. In the ranking, which includes scores for outages, customer perception and complaints, CGE had 1.07, 8.35 and 7.052 on a scale of 1 to 10, respectively.

The acquisition of CGE was made in Spain, so the question arises as to where the taxes are paid. According to BDO’s International Tax & Legal Director, Mauricio Benítez, there is a formula to define it. “China is going to buy from Spain, but it is a cross-border operation and the asset is in Chile. Therefore, it must be defined how much CGE weighs for Naturgy, and if it is more than 20% of the Spanish company’s assets, taxes must be paid in Chile,” he says.