With energy costs projected to be around US$ 30 per MWh in a rainy year, the electricity sector is preparing to face a new cycle of low prices, driven by the increased presence of renewable energy and the fall in fuel prices on the international market.

New cost scenario brings the electricity sector closer to Argentina’s gas era

A new scenario is being projected for the energy industry. The better conditions for investment, together with the international drop in fuel prices, are leading to the lowest marginal costs in the last decade in 2016, which is the value at which energy is traded between large companies and electricity companies.

In fact, the projected values are the lowest since the country’s generation park was supplied with Argentine natural gas, which occurred between 2000 and 2004, when the neighboring country began to close, little by little, the hydrocarbon tap.

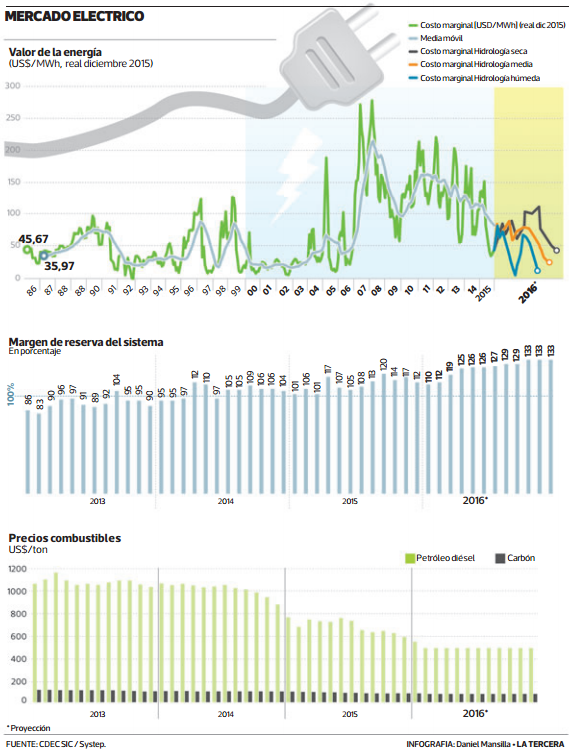

The change in trend is picked up by the Economic Load Dispatch Center (CDEC) of the Central Interconnected System (SIC), which in its report “The 12-month generation program”, projects price levels ranging from US$ 30 per MWh in wet hydrology to levels above US$ 100 per MWh in dry scenarios. In fact, according to CDEC-SIC analyses, in a dry hydrology, i.e., without rain, July and August could be the most expensive months in the system, with a peak of US$ 150 per MW, a cost attributable to a diesel-fired plant.

“Mainly it is influencing the greater supply that is occurring in the system, where we see that today there is greater ease to make projects. A significant percentage of these projects are renewable, whose variable dispatch cost is very low, sometimes even practically zero. This is what has allowed us to lower marginal costs, which is what we are projecting for 2016”, explains Andrés Salgado, technical director of CDEC-SIC.

He adds that the year is also expected to have a trend of low commodity prices, with coal potentially reaching US$ 73.6 per tonne and oil at US$ 480 per tonne (see infographic).

Increased NCRE contribution

The National Energy Commission (CNE) confirms the trend. Andrés Romero, executive secretary of the entity, points out that “the marginal cost scenario for this year is clearly more favorable than what has been seen in the system in the last five years”.

The increase in projects under construction stands out, which rose by nearly 40% between 2013 and 2014, from 2,671 MW to 4,492 MW. Of this number, Romero points out, half of the power corresponds to NCRE-based projects, initiatives that are connected to the system in a very short period of time and that have a shorter construction period, as some take less than a year. “The speed with which these projects have been able to enter service has strongly increased installed generation capacity, allowing the gap between generation and demand to be reduced,” says Romero.

Salgado explains that today the contribution of NCRE to the generation mix is 11%, but emphasizes that this percentage could be higher if there were no limitations on energy transmission that affect the northern part of the SIC. “If we didn’t have that limitation, the contribution could be two percentage points more,” he says.

More water and coal

Hugh Rudnick, an academic at the Catholic University and director of the electricity consulting firm Systep, explains that a not minor element that has also made it possible to reduce the costs of the electricity system is the greater availability of water resources. “This has displaced liquefied natural gas (LNG) and diesel generation. There is also a greater contribution from coal-fired generation today,” he says.

Regarding hydrological scenarios, Rudnick is clear: “the price trend will continue if there is a wet hydrology in 2016, but may be partially reversed if there is a dry year,” he says.

The industry is also analyzing the new scenario. Endesa Chile indicates that it expects lower spot energy prices, “consistent with the drop in fuel prices and greater availability of thermal generation”.

They add that, in this sense, a relevant role is expected from the Bocamina I and II coal plants, located in Coronel, given that the units totaling 478 MW were not present during the first three months of 2015.

Role of bids

The market is also highlighting the approaching of the operating costs of the plants.

Agustín Alvarez, Research Manager at Bice Inversiones, indicates that the evolution of the marginal cost of diesel, a fuel that is approaching the value of LNG, has been downward. “Recent quarters have seen a sharp drop from levels of US$150 to US$200 a MWh before the drop in fuel prices, versus the US$80 to US$115 a MWh level seen today,” he notes.

Meanwhile, combined cycle (thermal) plants that use LNG are operating at a cost of around US$ 60 to US$ 80 per MWh, while the operating value of coal plants is around US$ 40 per MWh.

Endesa Chile acknowledges that the gap between LNG and diesel is getting closer, but rules out an immediate risk of displacement.

For other companies, the sharp drop in the price of diesel, a fuel that, according to the industry, is no longer marking the marginal cost of the system, a process that occurs with the entry of the last power plant into the generation system, has been relevant.

These changes in prices are of concern to the private sector in relation to the impact that could exist between the operating cost of the power plants and the development cost of the projects, a difference that could affect the profitability of the initiatives.

In the industry, they are clear. The only thing that can guarantee the long term of the companies with these price levels are the supply contracts, which are achieved through bidding and have an impact on the electricity bills of Chileans.

“Today, there is a turnaround in prices, but there is a limit to this, which is the profitability of the projects. If there is an oversupply, the market will be ordered and a natural balance will be generated by virtue of the development cost of the projects. How can companies protect themselves? Through supply contracts, which is why the bidding process that the government will carry out this year is so relevant. This will give stability to all new investors, because they are long term”, explains an electricity executive.

Argentine gas

But how far are we from the time when the system operated on the basis of Argentine natural gas? Rudnick points out that there is still a gap, as this hydrocarbon was bought at US$ 1.5 per million BTU (British Thermal Unit), far from the US$ 8 to US$ 11 per million BTU that is paid today for Liquefied Natural Gas (LNG).

In addition, he points out that trans-Andean gas had other benefits. “At that time we had marginal costs permanently around US$ 30 to US$ 35 per MWh. Gas-fired projects had no competition, and even hydroelectric projects, which are the cheapest in our generation park, were no longer profitable. In addition, we were not as dependent on hydrology as we are today,” he recalls.

Romero points out that both scenarios are not comparable, because “today’s system is not the same as it was at that time in terms of its dynamics in the generation and transmission sector”.

A similar view is held by Endesa Chile, where they indicate that in those years the resource was abundant, of very low price and low variability. And the fuel was supplied through existing pipeline infrastructure. “Today we have an LNG supply whose price variability is much greater and whose supply logistics are also more complex. These elements are not comparable to make an analysis,” said the generator.

System clearance

Lower electricity demand is also an element that is influencing the new electricity system scenario. The CDEC-SIC estimate projects a demand for 2016 of 50,061 GWh per year, which implies a growth of only 1.02% compared to 2015, which closed with a demand of 49,551 GWh.

All these elements, summarizes Salgado, are causing the electricity system to show levels of slack not seen in other markets, since the reserve margin, which is how much more installed capacity there is with respect to maximum demand, is estimated at 140% (see infographic). He adds that today the Central Interconnected System has a maximum demand of 7,500 MW and that the installed capacity reaches 17,500 MW, “that is, the SIC has twice the power, and that does not happen in the world, those numbers do not happen”, says Salgado.

Interconnection effect

As for the permanence of this positive scenario, Romero is cautious. Despite pointing out that the following years should also be “positive years”, he emphasizes the elements that must be considered for this to happen, such as the evolution of electricity demand, the effective entry, in time and form, of the projects declared under construction -both in the generation and transmission sectors- and the variability of fossil fuel prices. Finally, it highlights the effects that the entry into operation of the SIC-Sing interconnection at the end of 2017 will have.

In this sense, Salgado is more optimistic, indicating that with the union of the two large electricity systems, the gap in the variability of costs that today is felt more strongly by the SIC, will be more attenuated, thanks to the greater presence of thermoelectricity that the new system will have.