The liberalization of the regulated market will open the door not only to new players in this industry, but energy trading could even be attractive to retailers and banks, despite the fact that international experience shows that residential customers, which in Chile represent half of all potential users, are rather reluctant to change supplier.

Jessica Esturillo O.

Source: El Mercurio

A few weeks ago, the Ministry of Energy embarked on the first of the three stages it defined to carry out one of the most complex reforms in the regulation of the energy sector: the modernization of electricity distribution which, being the most visible face for end consumers, is by far the most sensitive of the three segments that make up this business. The issue is so sensitive that at least two previous attempts to adjust to this regulation failed.

After a long analysis, the authority chose to initiate this legal adjustment with the liberalization of the regulated market through the creation of the figure of the electricity trader, which will be incorporated as a fourth actor in the supply chain together with generation, transmission and distribution. This implies that there will be companies that will be dedicated only to the retail sale of energy to the almost 7 million regulated customers, half of which are residential users.

“Companies will have to compete because we are their customers. This will translate into better service and lower prices,” says the Ministry of Energy. Minister Juan Carlos Jobet’s estimate is that if 100% of regulated customers were to become “free” customers, the system would have savings of US$ 800 million, while if only residential customers – the other half are small businesses, industries or offices – were to do so, that figure would be reduced by half. In terms of individual electricity bills, the estimate points to reductions averaging 20%.

The figure of marketer is not new; it has been operating for several years, for example, in Europe, the United States and Latin America. In some markets it has worked well, promoting competition and thus lower energy prices, while in other cases the experience has been less encouraging.

The Chilean project proposes to separate the operation of the electricity infrastructure, which would remain in the hands of the current distributors, from the sale of energy, which would be in the hands of these marketers. The debate has just begun and it will not be easy.

1 WHO CAN BE A TRADER? The project states that in order to be a marketer, a company with that line of business and headquartered in Chile must be built. It must also demonstrate a solvency that guarantees the supply committed to customers.

Companies in the electricity sector -generators and the distributors themselves, through independent companies and with possible restrictions on operating in their own concession areas- are the first candidates. However, Cristián Muñoz, director of Breves de Energía, says that this new business is a good opportunity for energy-related companies, such as gas or liquid fuel distributors, which could offer energy packages.

He also mentions mass retail companies because they would have the possibility of integrating benefits and services and, in his opinion, they would have a greater advantage to challenge other players in the electricity sector that are set up as marketers, such as generators or the current distributors themselves.

Sebastián Novoa, executive director of Ecom Energía, a firm that provides energy marketing services for free customers, says that in Spain, for example, the El Corte Inglés department store chain has been involved in this business, while some banks are making inroads in Brazil and Colombia.

2 IS THIS AN ALTERNATIVE FOR ALL CUSTOMERS? The bill divides customers into three groups: the free customers who have power over 5,000 kW and negotiate directly with the generators; the medium-sized customers with power between 21 kW and 5,000 kW, and the small customers who are the largest group and have connected power of up to 20 kW. This includes residential customers, whose power is up to 10 kW.

Marketers will be able to serve the latter two groups and will require licenses to be granted by the authority. Beyond Minister Jobet’s expectations, international experience shows that migration levels in these segments are rather low. In Spain, as of December 2018, the rate of change of domestic customers was 8% and that of the SME and industrial segment was 23% and 27%, respectively. In the United Kingdom, the switching rate for residential customers between 2013 and 2017 was 12.8% and in the same period in Norway it was 15.9%, while in Italy it reached 8%.

The associate director of the consulting firm Systep and academic at the University of Chile, Alejandro Navarro Espinoza, explains that the key lies in the price sensitivity of users. “If the residential user does not see a substantive gain that pays for the time effort of changing supplier, he will probably not do it. This may be different in medium and large users where the electricity payment may be a relevant component of their costs,” he says. He adds that interest in specific supplies – such as being 100% renewable – could provide an incentive to switch.

On the other hand, not all areas and not all customers have the same commercial attractiveness for marketers. Here, they say in the market, an observation to the Government’s project arises, since it intends to enable the so-called electricity portability gradually from cities, starting with the most vulnerable ones in social or environmental terms. This model would make the system economically unattractive because the commercial installation costs could be higher than the benefits that could be obtained.

The private parties argue that it would be more efficient to start the model with the highest energy consumptions to “build the muscle” to address lower consumptions later, especially in less dense or more remote areas.

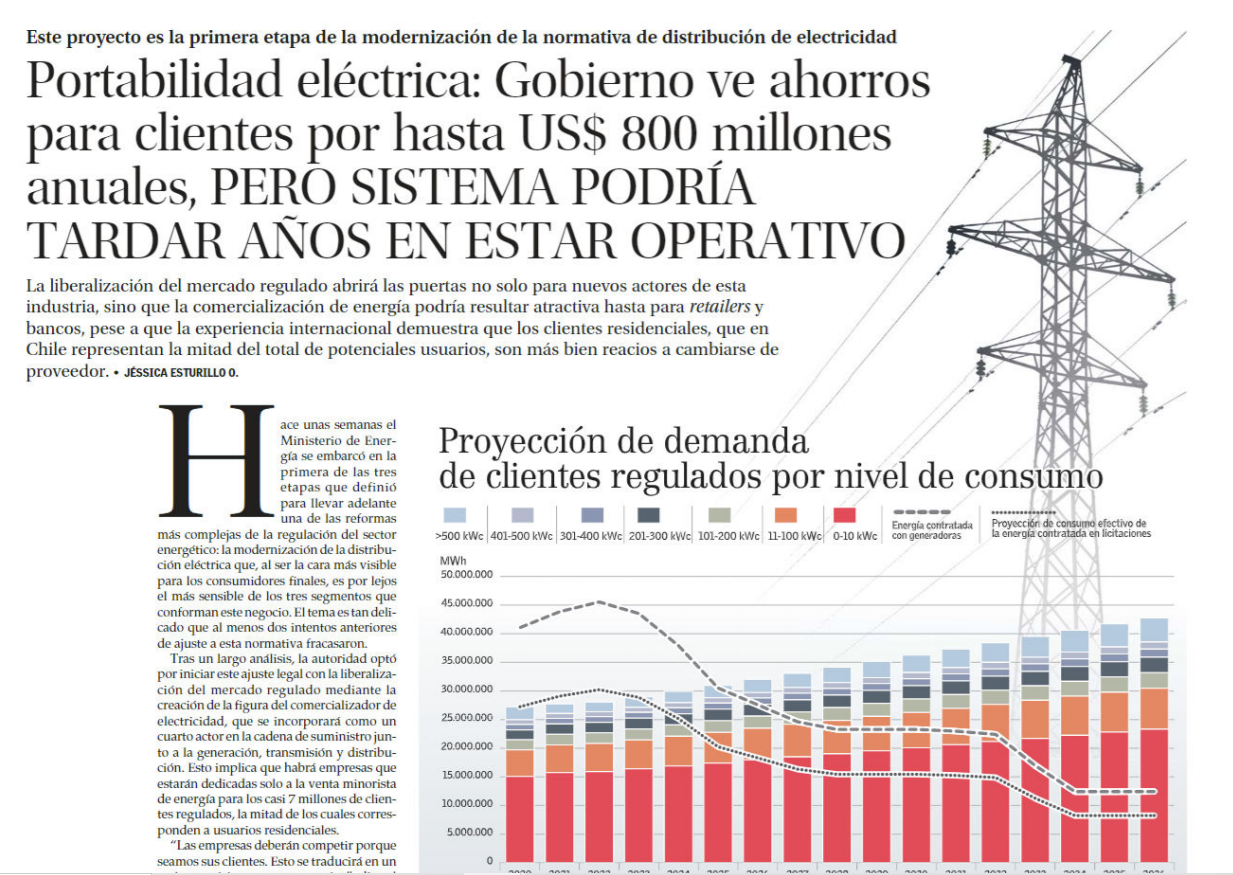

3 WHEN WILL IT BE POSSIBLE TO CHANGE? Here there is not a single opinion, because while the government assures that the system will be available one year after the project is approved, in the opinion of specialists, portability could only begin in 2023, when the projected energy demand would reach an adequate level. Today, on the other hand, demand is low and does not cover the energy already contracted in the regulated system. Other estimates suggest that this balance will not be reached before 2026 and that residential customers will be incorporated by 2032. This is because marketers’ strategies will aim to capture first the medium-sized customers and then the small ones.

Claudio Seebach warned this week in Congress that “there is today a lower demand for energy compared to what was awarded in the tenders carried out by the State and that is why a reform of the distribution segment must seek to avoid an impact on the economic balance of these contracts, which are precisely what make this energy transition in Chile possible”, he said.

4 WILL ENERGY BECOME CHEAPER? This is the question that has the most uncertain answer. There is no clarity as to whether the decreases that the authority has anticipated will respond to the effect of the greater competition that is expected or whether they will really be the result of a natural decrease resulting from the end of previous more expensive contracts and the entry of other cheaper ones, awarded in the last supply tenders.

Another factor that would influence, they say in the industry, is the freezing of energy prices to avoid new increases in electricity bills, since this mechanism considers that until 2027 regulated customers will pay additionally for the energy they are not being charged for now, even if they have migrated to the free system. This would reduce the attractiveness of the suppliers’ offer, a figure that, in the opinion of some analysts, would only create an additional distortion to those incorporated in the last twelve months to avoid new increases in electricity bills.

Navarro Espinoza says that the tariff benefits with respect to the marketer are clearer for medium-sized customers, and that there are doubts with respect to the domestic segment because it is less price elastic and, at the same time, due to its consumption volumes it would be less attractive for marketers. “All in all, the marketer’s idea is a good one, especially in the non-domestic sector. In the domestic sector, the authority will have to show that the benefits are greater than the associated costs, always trying to keep these costs as low as possible,” he says.