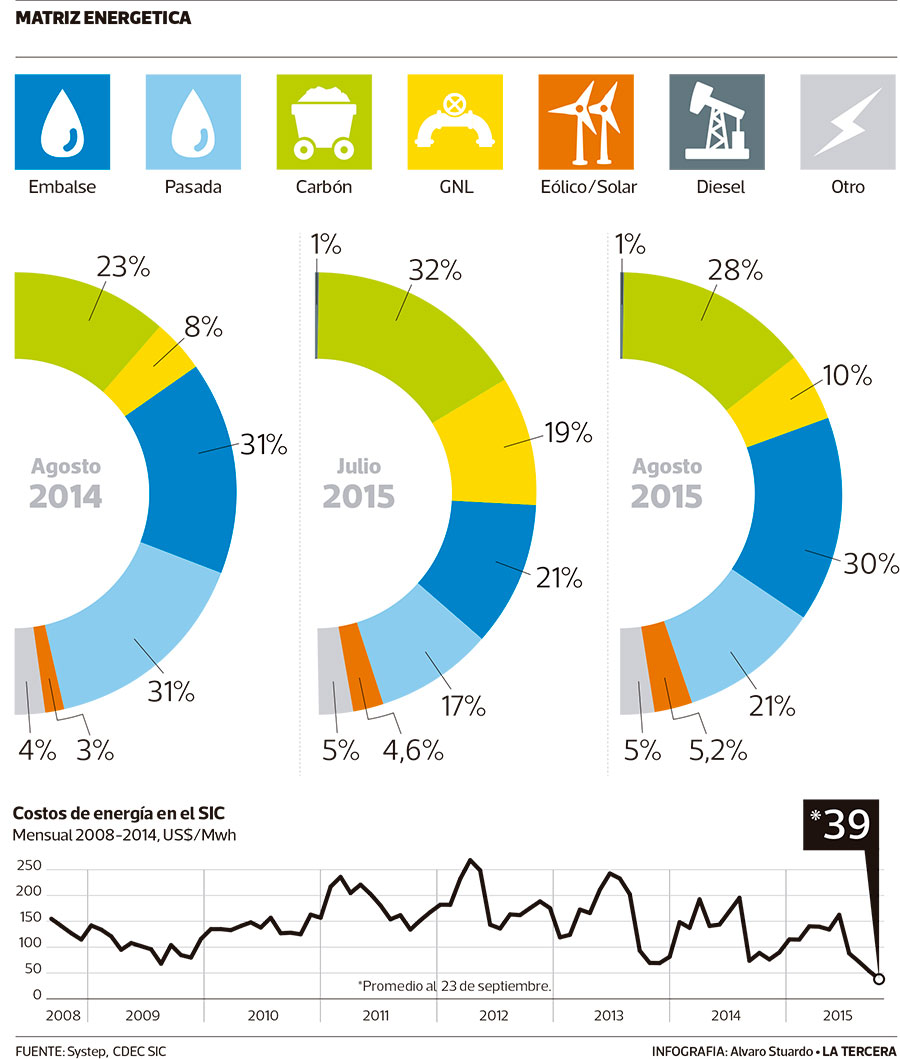

Prices are now at their lowest level in almost a decade, due to the increased presence of water and lower fuel prices. The government believes that exorbitant prices will not return. It also expects a greater presence of renewable energies: in August they accounted for 10% of the total.

The changes that the electrical system is undergoing today

The operation of the national electricity system is facing a particular year. The strong onslaught of non-conventional renewable energies (NCRE) is reflecting the need to improve the way in which the system that makes it possible for every home, work, school or green area to have electricity to operate.

In August, energies that qualify as non-conventional renewables, in accordance with the January 2007 standard, contributed 10.34% of effective energy production, according to Andrés Salgado, executive technical director of the CDEC-SIC, the entity that coordinates the operation of the electricity system. And of that total, 5.2% of the generation obtained was thanks to wind and solar photovoltaic energy -which have a high intermittency-, according to the latest report by Systep, a company that analyzes the electricity system and is led by Catholic University academic Hugh Rudnick. In the same month last year, this type of variable technologies only contributed 2.6% of effective generation (see infographic).

But the variability of the operation of this type of technology, together with the tightness in the transmission of energy that affects the northern area of the Central Interconnected System (SIC) -III Region, is damaging not only the foreign companies that have installed wind or photovoltaic plants in that area -which cannot place all their energy in the system-, but also AES Gener’s Guacolda thermoelectric complex, which must lower the intensity of its activity (operating at the technical minimum), according to the intermittency of variable energies.

The coordination of the operation is not left out of the impact of the intermittency of these sources: “The technical challenges that some of the technologies qualified as NCRE have are related to the intermittency of their production, a situation that has also represented a challenge for the coordination of the operation of the system in charge of the CDEC-SIC”, acknowledges Salgado, although he stresses that the situation could improve in a few more years, when the country already has the interconnection of the electricity systems and also when the transmission line led by the Colombian Isa through Interchile, which will go from Cardones to the area of Polpaico, which is expected by the end of 2017, is operational. “This will allow energy to flow: when there is sun and wind, it will allow that cheap energy to flow to consumption centers in the center and south, and when we have high water flows in the south, it will also flow to the north,” says the executive secretary of the National Energy Commission (CNE), Andrés Romero.

For this reason, Romero minimizes the problems that the electricity system is experiencing today. “The discourse that has been tried to generate about the problem of the intermittency of renewable energy shows rather the resistance of the market to a change, but in the world this has already had a solution and we are on that path,” he says.

High costs are a thing of the past

The most important solution, says Romero, is to have a more robust transmission system, which will be achieved by the end of 2017. This change will have a significant impact on the country’s marginal cost, which is the value at which energy is traded between large consumers and electricity companies.

According to the CNE, when this new scenario is operational, “there should be stability in marginal costs, which will fluctuate between US$ 60 and US$ 70 per MW/h”, says Romero. “What we can say is that this situation of exorbitant marginal costs of US$ 200 per MW/h or even US$ 250 per MW/h is no longer being seen by us or by the market,” he explains.

More water and snow

Today, a change in the price trend of the country’s largest electricity system is already being felt. In August, the value of energy averaged US$ 54.6 per MW/h, compared to US$ 73.3 per MW/h in the same month last year (-27%). “Not since 2006 have marginal costs been so low in the SIC,” says Systep’s monthly report. The stock has maintained its downward trend. The average through September 23 was US$ 39 per MW/h (see infographic).

What has had an influence is the increased use of hydroelectric technologies. In the eighth month of the year, the contribution of hydroelectric power plants reached 51%, far from the 38% they contributed to the generation mix last July. Although Andrés Romero is cautious and says that the five years of drought are not yet behind us, he highlights the better indicators for the thaw period, from October to March 2016. “The amount of snow that has fallen bodes well for higher hydro availability,” he says.

So much water has fallen in the south of the country that Endesa has had to dump it, acknowledges Endesa’s general manager, Valter Moro. “Due to the last storms, we had spills from some of our plants, which has resulted in very low prices in the areas where the facilities are located,” he explains, and says that he sees no need for new spills. “We don’t see anything exceptional happening in the next few months, and if there are zero marginal costs, they will probably be hourly events and limited territorially,” the executive said.

Another element influencing the fall in prices is the drop in fuels on the international market, such as coal, which went from US$ 100 per ton to the current US$ 70 per ton, and oil, which on Friday closed at US$ 45.70 per barrel, versus US$ 61.43 per barrel last June (-26%). “The current price decline is largely impacted by the price of oil, rather than domestic factors,” Moro points out.

Final account

But the government is not only optimistic about the value of energy impacting large consumers, but also the end customer. Romero sees a positive scenario for electricity bills in the medium and long term, as he estimates that the supply tender to be held in April 2016, energy that will mostly be used to renew existing contracts, will have even lower prices than those estimated in the Energy Agenda. “In the Agenda we talked about an average price of US$ 95 per MW/h, but we believe it will be lower than that. This, because of the increased competition we expect,” he projects.

For the partner of Electroconsultores, Francisco Aguirre, the government “has been very lucky”, because in addition to lower fuel prices, electricity demand has suffered. “Prices rise with demand and demand is depressed. With this demand condition, we have installed capacity to spare, and with the low prices that fuels are registering, a price-opportunity figure is created that will result in cheap energy prices,” he says.

The behavior of demand is an item that the CNE varied in its last node price report. For this year they project growth of 3.8% versus 4.6% that they estimated in October 2014, and for the next 10 years, an average growth rate of 3.5%.

With this lower consumption, there is no urgency for new installed capacity. “We are no longer dependent on a project,” Romero assures. “Our conclusion in this regard is clear. If we add the projects that are under construction plus those that are going to materialize because they won a bid, we are in a radically different situation to what we had at the beginning of 2014. The urgent need for new facilities no longer has the same urgency as before,” says Andrés Romero.