Systep points out that tariffs will increase anyway under the new scheme. Generators are concerned about greater attribution for the CNE.

Up to 19% increase in electricity bills estimated despite government plan to lower rates

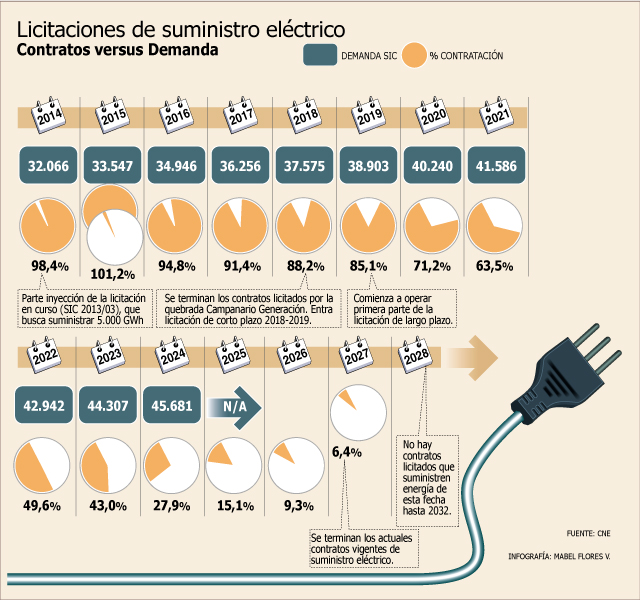

Although the government is determined to curb increases in electricity rates for regulated customers, including residential customers, these will still show increases, which could reach up to 19% in the next decade.

This is the estimate made by the consulting firm Systep in its most recent market report, where it states that even if the modification to the bidding system promoted by the government is successful, customers will have to live with higher prices.

“An improvement in the bidding mechanism represents a reform to the heart of the electricity market. If the reform is implemented efficiently, and the government’s proposed target is achieved, BT1 (residential) tariffs will rise by 2025 by between 11% and 19% compared to 2013, depending on the distributor. The cost of not making a good reform is that consumers will have higher increases”, says the firm linked to the academic Hugh Rudnick.

One of the goals of the Energy Agenda is to reduce the prices of regulated contracts by 25%, from US$ 129 per MW/h to US$ 98 per MW/h.

The Minister of Energy, Máximo Pacheco, has reiterated that since 2010 electricity bills have risen 20%, and that if there are no changes, they will increase by another 34% in the next decade. By the end of this year the accounts will rise between 6% and 8%, the Secretary of State said in June.

Powers of the CNE

Although the private sector appreciates the auction reform, they are concerned about the greater powers granted to the National Energy Commission (CNE).

Systep argues that an independent “bidding” agency should be created, guaranteeing the private sector a technical and economic process free from exposure to the political cycle.

In this respect, René Muga, executive vice-president of the Association of Generators, pointed out that the proposed role of the CNE, especially in the preparation of the bases for these tenders, opens up spaces for greater discretion.

“The counterpart that will be the CNE, instead of the distributors, opens, in our opinion, more interference of greater discretion in the administration of a relationship that was previously between distributors and suppliers and generators and, in our opinion, involves a situation not entirely resolved of what happens when the energy that is needed to supply the regulated parties is not subject to contracts,” he said.

Sebastián Pizarro, who represents small and medium-sized firms (with installed capacity of less than 200 MW), agrees. He also argues that extending the limit for free customers to opt to be regulated from 2 MW to 10 MW could cause problems for the system.

“The market could reach %-85% regulated clients -today it is 70%-, which implies adding some 5,000 additional GW. That has to be supplied, and in the current scenario it is impossible to meet the conditions requested,” said Pizarro.

In this regard, the executive secretary of the CNE, Andrés Romero, flatly ruled out that the bill already in the legislative process would increase discretionality.

“The CNE has all the competencies, history and tradition to develop processes of high technical expertise. There is an unfounded questioning of the role that a technical body can play in determining how the market works,” he said a few days ago.

GENERATORS: TIGHTNESS UNTIL 2020

In the opinion of Sebastián Pizarro, president of the association of small and medium-sized generators, the government’s diagnosis for reforming the system is based on an error: “the problem is that we have had a six-year drought and also that projects cannot be built”, he says. He believes that far from promoting competition, which, he argues, “already exists in the market”, the new regulation would directly affect smaller companies, which today have 20% of the installed capacity of the SIC, with some 4,000 MW. It also indicates that lower prices will only be achieved if the bidding conditions reflect investors’ concerns, as the market will remain tight at least until 2020. The bidding reform bill entered Congress in mid-August and is currently being analyzed by the Chamber’s Mining and Energy Committee.